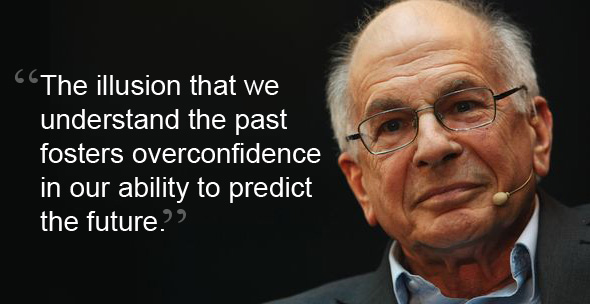

Daniel Kahneman: The Psychologist who won a Nobel Prize for Economics

Daniel Kahneman and his colleague Amos Tversky studied human behaviour when faced with uncertainty and risk, and came up with groundbreaking results; primarily, that human beings are not necessarily the rational agents of economic theory. Daniel Kahneman was awarded the Nobel Prize for Economics in 2002 for his pioneering contributions; Amos Tversky couldn’t be awarded the prize as he had passed away, and the prize is not awarded posthumously. So what is this theory that has become the bedrock of behavioural economics?

Expected Utility = Rational Choices Made by Rational Agents

Expected utility theory had earlier dominated the analysis of decision-making under risk. Consumer theory is based on the principle that economic agents seek to maximize their utility subject to a budget constraint. However, when we move from concrete goods, for which there is a price either in terms of the exchange value of one good for another or in terms of a monetary price, to possible outcomes for which there are distinct probabilities, the theory must be tweaked.

In such a case, the economic agent maximizes his expected utility, or the sum of the utilities that the agent assigns to each outcome, weighted by the respective probabilities for each outcome. Here we consequently assume firstly that economic agents have all the information at hand. They are aware of each outcome and the probability of that outcome occurring. Secondly, we assume that the economic agent assigns utilities independent of how the outcomes are stated; I.e., the agent assigns the same utility to an outcome, whether it is presented as a gain or as a loss.

Observations that are Contrary to Expected Utility Theory

Kahneman and Tversky showed, through a series of experiments, that people do not, in fact, behave according to the assumptions of expected utility theory. The observations that the two made include the following:

- People underweight outcomes that are merely probable in comparison with outcomes that will occur with certainty. This is known as the certainty effect. The result is that people are risk averse when it comes to choices involving sure gains, and risk seeking in choices involving sure losses.

- People tend to not take into account factors that are common to all the prospects, a tendency known as the isolation effect. This leads to inconsistent preferences when the same choice is presented in different forms.

Prospect Theory

Kahneman and Tversky came up with the Prospect Theory of decision-making. This theory highlights the following key ways in which decision-making differs from what the expected utility theory would propose.

- People have a strong preference for certainty, and are willing to sacrifice income to achieve it. For example, when faced with $1,000 for sure and a 50% chance of earning $2,500, people would choose to take the $1,000, even though expected utility theory says that given the preference should be for the second option, as the expected utility is $1.250 compared with the first one’s $1,000. Thus, people are risk averse when it comes to sure gains.

- If the problem is reversed, i.e. a loss of $1,000 for sure or a 50% chance of losing $0 or $2,500, people tend to choose the second option. Thus, people are often risk-seekers when faced with sure losses.

- People tend to use factors as revenge or a desire for fair play while making decisions. They are more interested in how they are positioned relative to others, rather than just evaluating the gains to themselves.

- People tend to underreact to what they see as low probability events. This could explain the irrational fluctuations of the stock markets; when the markets are going up, people want to invest more and more, thinking that the probability of the markets falling is very low.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

What the readers are saying…