Argentina’s Shift to Free Market Policies Is Starting to Pay Off

From a $20 billion bailout deal with the IMF in April 2025 to the same agency projecting GDP growth for the year at 5.5% in August, Argentina has certainly come a long way. Does the credit for this go to President Javier Milei’s attempts to bolster the economy through free market policies? Here’s what we know so far.

Javier Milei’s Plan for the Argentinian Economy

Argentina’s economy has long been a source of instability. For decades, the country struggled with high government spending and a massive fiscal deficit. These issues often led to a cycle of high inflation and economic stagnation. However, a new approach is now in place. President Milei, a self-described “anarcho-capitalist,” took office in late 2023 with a bold plan to fix the economy. His strategy focuses on fiscal discipline, deregulation, and ending the practice of printing money to fund government spending.

Milei’s first major goal was to repair the country’s public finances. He took aggressive steps to cut government spending, which included reducing subsidies and public sector jobs. This approach was aimed at achieving a fiscal surplus, something unheard of in recent Argentine history.

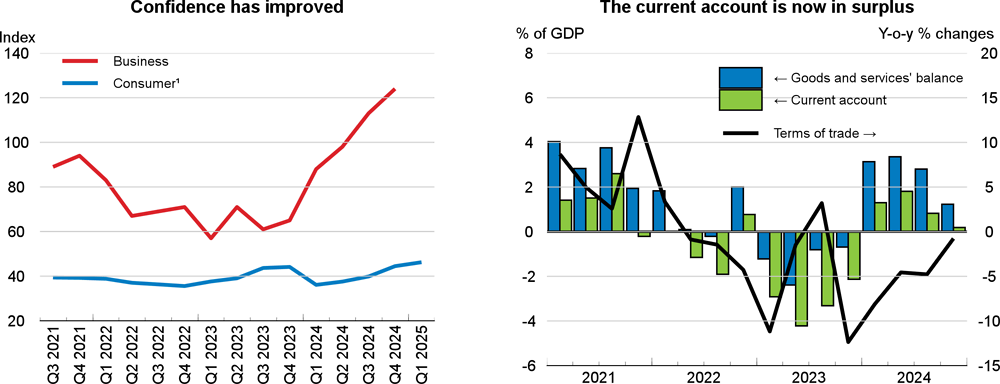

The results have been significant. The government has consistently posted a fiscal surplus, which has been a key factor in restoring market confidence and lowering the country’s risk rating.

Source: OECD

Source: OECD

The most visible result of these policies has been the sharp decline in inflation. Argentina had an annual inflation rate surpassed 211% by January 2024. By mid-2025, that number had fallen dramatically to around 43.5%. Monthly inflation rates have also seen a remarkable drop, with some months recording figures as low as 1.5% and 1.6%. This is a huge improvement. The easing of inflation has been achieved by curbing the central bank’s speed of printing money to finance government deficit.

While these measures have brought economic stability, they have also come at a social cost. The cuts in public spending led to a recession at the beginning of 2024, and the poverty rate increased. However, the economy has shown signs of a rebound. Key sectors, like agribusiness, mining and energy, are leading this recovery. The government has also lifted some currency and capital controls, which were a major obstacle to the economy.

Deregulation is another core part of Milei’s plan. A key example is the housing market. By lifting rent controls, the supply of rental properties in Buenos Aires surged 195.23% and median prices dropped. This shows how freeing up the market can have a direct positive impact.

The Future Looks Bright

While initial reforms caused a recession in early 2024, the economy has begun to rebound. While the IMF projects GDP growth of around 5.5% for 2025, the OECD is also optimistic, expecting the GDP growth rate to hit 5.2% in 2025 and 4.3% in 2026. This recovery is largely driven by export-oriented sectors like agriculture, mining, and energy.

The government also achieved a fiscal surplus, a significant feat after years of deficits, which has helped restore some market confidence. While many challenges remain, the initial data suggests that Argentina’s shift to free-market policies is beginning to pay off. The country is taking steps toward a more stable and prosperous future.

Speed Bumps in the Road to Recovery

While Argentina has made progress in curbing inflation and money printing under President Milei’s reforms, the adoption of free market principles is incomplete. Tariffs remain high, hindering international trade and competition. The nation’s public debt is also a significant concern. The central bank continues to print money, although not at the levels seen earlier. Due to this, inflation is still high. These issues, if not addressed soon, could act as major obstacles in the path of Argentina’s economic recovery.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

What the readers are saying…