Japan is Betting High on Casinos for Economic Growth

For nearly a decade, Japan’s political stance on casinos resembled Newton’s Cradle. After years of deliberations, the country finally seems to be moving forward to opening its economy for the casino industry.

In late April, the Japanese government signed off on the IR Implementation Bill to legalize integrated resorts. The passing of this Bill would pave the way for casinos to be built in the country. But that’s not all. This would represent a significant milestone in the global casino industry.

Japan Casino Industry: Twofold Approval

In December 2016, the IR Promotion Bill was passed, removing a ban on the construction of integrated resorts (defined as resorts that included a casino). This in itself was a major step. The Bill needed to be approved by the so-called National Diet (or simply Diet), which is Japan’s bicameral legislature, comprising of a lower house (the House of Representatives) and an upper house (the House of Councillors).

After both the houses of the Diet approved to lift the ban, the Japanese government commenced work to submit the IR Implementation Bill, which was meant to include details of regulations and measures that would need to be incorporated to ready the country for the casino industry. This Bill took about a year to be framed and submitted to the Diet.

The Diet is now all set to address the IR Implementation Bill, which is widely expected to get a green signal from both the houses. The Japanese government has plans to extend its session to late June or early July to facilitate talks on the future of the country’s casino industry.

Japan Casino Industry: Miles to Go

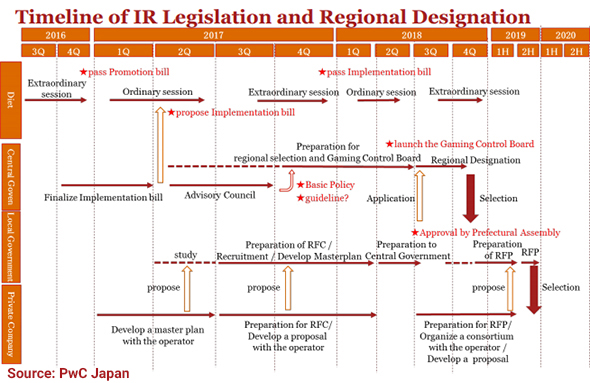

Assuming the Bill is approved by July, here’s a look at the expected timeline.

Japan Casino Industry: Restrictions

Seems like governments can’t refrain from placing restrictions! Here are some regulations that could limit growth:

- So far, the Bill has authorized only three integrated resorts to be built in preapproved locations.

- Companies seeking to operate casinos would need to apply for licenses.

- The space allocated for a casino must be less than 3% of the total space of the resort, to a maximum limit of 15,000 square meters or 161,458 square feet.

- A 30% tax rate would be applicable to GGR (gross gaming revenue).

- Japanese residents won’t be permitted to visit casinos more than thrice a week to a limit of ten times a month!

Japan Casino Industry: Bright Prospects

Despite the many restrictions, Japan’s casino industry does have bright prospects. A Morgan Stanley report published in April 2018 estimated that the country’s casino industry could generate at least $15 billion in gross gaming revenue (GGR) annually. A more recent report by Fitch Ratings estimates the GGR at below $6 billion. Fitch Ratings’ lower estimate could be a result of all the regulatory restrictions being placed.

Speaking to the Nikkei Asian Review, MGM Resorts CEO James Murren said the three resorts authorised so far would “generate billions of dollars, making the (Japanese) market vastly larger than Singapore.” MGM is among several casino giants bidding for a gaming license in Japan.

The IR ban lift would see projects of such mammoth scale as never seen before in any industry in the country. The Japanese government had outlined economic goals to be achieved by the opening up of the casino industry. The main economic goal was identified as boosting the tourism market, in terms of foreign visitor trips to Japan, duration of stay and spend per visitor. Japan’s Prime Minister Shinzo Abe expressed optimism around this goal being met, stating, “The bill will enable us to achieve our policy aim to promote long stays by tourists from all over the world.”

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

What the readers are saying…