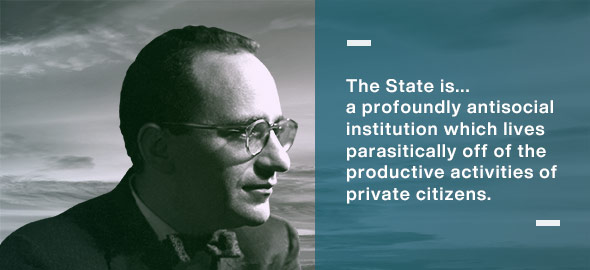

Murray Rothbard: Author, Economist & Anarcho-Capitalist

Murray Newton Rothbard was one of the most important leaders of the American libertarian movement of the 20th century. He proposed a form of free markets that he termed “anarcho-capitalism.” This was both a philosophical and an economic belief that individual responsibility is more important that government control. During his lifetime, he remained mired on controversy due to his beliefs. He was opposed to taxation, which he equated to a form of slavery. His concept of free markets included services that are typically considered to be the function of the government. He believed that anarcho-capitalism was the way to put an end to government control and monopoly.

A Controversial Economist

Rothbard possibly led the most difficult challenge against the legitimacy of government through a career that spanned over 40 years. He proposed that private citizens, private businesses and voluntary associations could take care of all the needs of a country. He believed that bureaucrats and politicians cannot fix the problems that plague the free markets, since they are “imperfect human beings,” with “limited knowledge” and focused on their own interests. At the same time, they possessed the power to disrupt the economy, an ability that even the greatest corporate executive did not have.

What he proposed is that individuals should be allowed to pursue their own business, without interference from the government. He recognized that there are several problems that impact the private sector but insisted that governments have historically only worsened the situation by oppressing people and suppressing enterprise. In fact, Rothbard stated that governments are driven by a desire to expand their power, rather than serving the people. This is irrespective of which political party might be in power.

Drawing on the Austrian theory of the credit cycle, Rothbard showed that the Great Depression was triggered by the 1929 bust that followed reckless credit expansion in the 1920s by the Federal Reserve, the Bank of England, and other major central banks. The economic correction of 1929-1930 might have resolved itself fairly quickly (as had happened previously following the Panic of 1907 and the severe recession of 1920-1921), Rothbard explained, but the interventionist policies of Presidents Hoover and Roosevelt prevented the markets from returning to equilibrium. The New Deal exacerbated and prolonged the event in a textbook case of misbegotten government intervention worsening the very problems it was supposed to cure.

Life and Times of Murray Rothbard

Murray N. Rothbard was born on March 2, 1926, in Bronx, New York. He was the only child of Russian and Polish immigrants, Rae and David Rothbard. After completing high school in New York City, Rothbard went on to earn his bachelors and then Ph.D. degrees in economics from Columbia University. He is said to have had political differences with his fellow students and professors, who he believed were “leftists.” Rothbard has an exemplary academic record, excelling in both school and university.

During his formative years, Rothbard was influenced by Austrian economist, Ludwig von Mises. He had attended one of Mises’ seminar at New York University in the early 1950s, which left a lasting impact on Rothbard. In fact, Rothbard went on to write a book that examines the economic theories of Mises. Much later, in 1982, Rothbard established the Mises Institute in Alabama to promote his political and economic ideas.

Murray Rothbard was one of the most influential figures in the modern libertarian movement in the United States. More specifically, he followed a right-libertarian ideology, known for its strong political views, such as the abolition of a welfare state approach. He founded the Center for Libertarian Studies, as well as the Journal of Libertarian Studies.

His demise on January 7, 1995, has been a great loss for the world. However, his contributions to leading publications, like the Wall Street Journal, New York Times and numerous economic journals, as well as his books continue to influence economic thought.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

What the readers are saying…