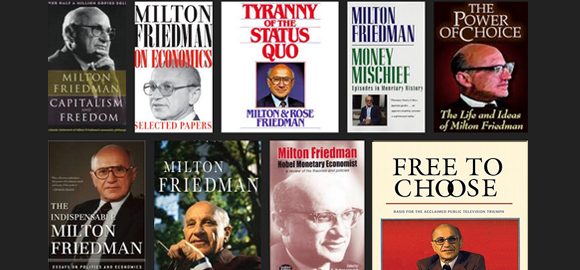

The Life and Works of Milton Friedman

Milton Friedman headed the Chicago School of Economics, and was the honoured recipient of the Nobel Prize in Economic Sciences in 1976. This American economist and statistician was described by The Economist, a British newspaper, as “the most influential economist of the second half of the 20th century…possibly of all of it.” His strong views on macro and microeconomics, economic history and public policy issues have surfaced in many books, scholarly papers, magazines, television programs and lectures. Friedman also was an adviser to American President Ronald Reagan. His political beliefs espoused the intrinsic worth of a free market economic structure.

Milton Friedman: Early Life

Born July 31, 1912, in Brooklyn, New York, Friedman grew up in Rathway, New Jersey. He was always a talented student and went on to graduate from Rutgers University in 1932. He specialised in Mathematics and Economics. During his time at Rutgers, he was influenced by two professors, Homer Jones and Arthur F Burns, and like them, he was convinced that modern economics might end the Great Depression. He went on to get his Master of Arts from the University of Chicago in 1933, where he also met his future wife and budding economist, Rose Director.

After that, Milton Friedman climbed his way up the career ladder, assisting and working with many researchers like Henry Schultz, Harold Hotelling, W Allen Wallis and Simon Kuznets, to name a few. In 1946, he accepted a teaching position at the University of Chicago, where he went on to work for the next 30 years. He contributed to the establishment of an intellectual community at the university, which was collectively known as the Chicago School of Economics. This school gained renown as the alma mater of a number of Nobel Prize winners.

Milton Friedman: Economist

Economics was dominated by free market convention and it was John Maynard who changed its face in 1936, when he published The General Theory of Employment, Interest, and Money. Before him, all classical economists’ recommended that the factors of demand and supply work should work things out, in case of any economic discrepancy. However, they never offered a solution to the Great Depression. Through the later 1930s, a free market tenet was not able to control it either. So, Keynes metaphorically was the “Martin Luther” of economics, providing the right intellectual rigidity that the economy needed. ‘Keynesianism’ was a much needed reformation in economic thought of the time.

After Keynes, many economists contributed to the revival of economics over the past six decades, but none were as influential is Milton Friedman. And keep Keynes’ metaphor in mind, Friedman was the “Ignatius” of economics. Classic economics regained much by the end of the century, and to that length, he deserves much praise.

Milton Friedman: Economic Contributor

He was best known for his Theory of Money and was the key advocate of the Monetarist School of Thought. He wrote at length on the Great Depression and went on to call it the Great Contraction, arguing that its seriousness was greatly aggravated by the misguided Federal Reserve policies.

Friedman played three important roles, contributing to the intellectual milestones of the century. As an economist, he wrote on the technical analysis of consumer behaviour and inflation. As a policy entrepreneur, he campaigned for the adoption of monetarism, which was part political and part economic. And as an ideologue, he greatly popularised the free-market doctrine.

Although he contributed greatly to macroeconomics, he knew where to draw the line. In the 1970s, many economists pressed his analysis of inflation to its limits and his ideas were brought under the spotlight in many further academic scrutinises. However, Friedman was a never part of all this. For him, that would be taking the idea too far. And so, his theories have lasted to this day, something which many of the other extreme theorists could not achieve.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

What the readers are saying…