Global Casino Giants Looking to Get a Slice of Japan’s IR Market

Over the past few years, Asian markets have become prominent hubs of the Integrated Resort (IR) business model. IRs are complex resorts offering diverse leisure activities, right from huge hotels to entertainment facilities like fun shows, shopping malls, theme parks, night life venues and more. Although they all offer different facilities, there is one common ingredient – they all house a casino.

IR Models: A Shadow Booster for Asian Economies

Gaming has been a vital part of the IR model since the 1990s. Over the years, the IR industry has served as a booster for economic growth in Asia. In 2017, Macau earned over $33 billion a year from casinos, which was almost 50% of the region’s total GDP. This figure grew by 14% in 2018 to $37.6 billion. Singapore established two IRs in 2010 – World Sentosa and Marina Bay Sands – and casinos continue to be the main revenue driver for the expansion of these businesses. In fact, Marina Bay Sands is a hugely popular tourist attraction, attracting international tourists to the country.

Japan Decides to Change its Fate

Japan is among the latest Asian economies promoting integrated resorts. In June 2018, the IR Bill was passed in the country’s House of Representatives, although the IR Promotion Law was enforced in December 2016. The target seems to be the 2020 Tokyo Olympics and Paralympic Games. Japan’s plan to boost tourism ahead of these events and beyond is what makes the country an attractive market for casino operators. The Japanese government aims to attract over 40 million tourists by 2020 and has a long-term goal of 60 million tourists by 2030.

This could be a vital boost to Japan’s economy, which is still grappling with deflation and slow growth, despite ‘Abenomics’. A declining taxable, working age population and rising debt levels have also added to Japan’s economic woes. Experts suggest that job creation would be a major benefit of the government’s IR initiative, which will support economic growth or at least arrest the decline.

The government’s IR Promotion Law will allow up to three coveted gaming licenses for the development of integrated resorts around the country. The Japanese casino market is estimated to be worth over $18 billion a year, according to Nikkei Asian Review, which is why the world’s largest casino resort companies are now vying for a piece of it.

Casino Giants Looking to Enter Japan’s Nascent Casino Industry

Wynn Resorts has expressed its desire to build the world’s largest integrated resort in a city like Tokyo or Osaka. Although the government has not issued any formal plan regarding the licenses and location of the three resorts, Osaka has been very keen to attract these companies. In June 2019, the IR Promotion Bureau in Osaka Prefecture announced that seven casino operators were vying for gaming licenses in the city.

Among these are casino behemoths like Las Vegas Sands, Wynn Resorts and MGM Resorts International. In a surprising move, Caesar’s Entertainment Corp has recently pulled out of this race, citing that it intends to focus on the completion of its $17.8 billion merger with Eldorado Resorts.

The Osaka Prefectural has estimated a total of 1.96 trillion yen in economic benefits for developments and business operations with over 97K jobs generated per year, as a result of the IR plan.

Asian giants like Melco Resorts and Entertainment and Genting Singapore are other companies in the race.

Creating an Integrated Resort plan speaks of Japan’s social and economic aspirations. Although naysayers have waged a decade long campaign against the decision to legalize casinos, PM Shinzo Abe has set his eyes on the tourism boosting potential of the IR industry. This could be a new chapter for the world’s fifth largest economy and its international competitive power.

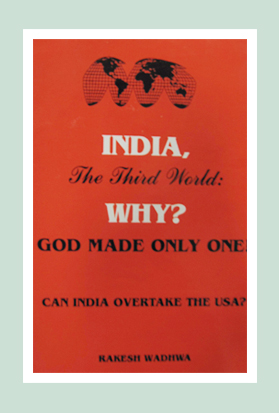

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

Rakesh Wadhwa. Ever since, I was a school boy, I knew India was on the wrong path. Socialism was just not what we needed to get ahead. Government controlled our travel; government controlled our ability to buy and sell; and government controlled our freedom to move our money. My life has focused on the inherent rights people have. When I was in college, I never understood, what the governments meant by their "socialistic attitude". If people are free to buy, sell and move their capital themselves without any restrictions by state, then the welfare of people is inevitable & hence the countries they live in will become wealthy. The government has no right whatsoever, to point a finger at me or my business. I am not a revolutionary. I just want to light up my cigarette and not get nagged about it. I believe in non-interfering attitude to attain more.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

The Bastiat Award is a journalism award, given annually by the International Policy Network, London. Bastiat Prize entries are judged on intellectual content, the persuasiveness of the language used and the type of publication in which they appear. Rakesh Wadhwa won the 3rd prize (a cash award of $1,000 and a candlestick), in 2006.

What the readers are saying…